37+ how many hard inquiries for mortgage

Take Advantage And Lock In A Great Rate. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

How Many Hard Credit Inquiries Is Too Many Experian

This heightened credit risk.

. In general six or more hard inquiries are often seen as too many. Web How Many Hard Inquiries Is Too Much. However with the most-used FICO model all inquiries within a 45-day period are considered as one inquiry when you are rate shopping such as for mortgage student and auto loans.

Web Ultimately you could have your credit pulled by 10 mortgage lenders in a week and it would only count as a single inquiry. Web Hard inquiries make up 10 of your credit score and can hurt your credit score by up to 10 points regardless of whether you get the loan. Web Read on to learn how many hard inquiries are too many and how multiple credit checks can affect your credit.

Business Credit Business Financing. Use NerdWallet Reviews To Research Lenders. FICO would consider those five hard.

Depending on your existing credit history these might drop your score by a handful of points or not even have a noticeable impact. Use NerdWallet Reviews To Research Lenders. Ad See If Youre Eligible for a 0 Down Payment.

Web An exception to multiple hard inquiries reflecting poorly on your credit score is when shopping for a mortgage auto loan personal loan or student loan. Web A hard inquiry is a request to check your credit typically to make a decision about your loan or credit card application. So if you settle on a loan during that 30-day time period your.

Take Advantage And Lock In A Great Rate. Browse Information at NerdWallet. Hard inquiries can usually take up.

Web Equifax no baddies. However apply for additional accounts in a 12-month period and youll begin to feel the pinch. Web How many hard inquiries is too many.

Web A single hard inquiry can shave up to 5 points off your FICO score. Web by Gerri Detweiler December 10 2019. Web For many lenders six inquiries are too many to be approved for a loan or bank card.

For example lets say you shopped for a mortgage with five different lenders over a period of 14 days. Apply Online To Enjoy A Service. Even if you have multiple hard inquiries on your report in a short period you may not see negative consequences if youre shopping for a specific type of loan.

Web The average consumer is expected to acquire one or two hard inquiries a year. If you suddenly have a lot of inquiries it can look bad to potential creditors. This shopping period can range from 14-45 days depending on which version of the FICO scoring formula is being used.

So Ive read and seen firsthand last year that if you do all your mortgage shopping within 15-45 days then they all count as 1 single hit against your FICO. Ad Learn More About Mortgage Preapproval. I applied to 4 banks and hence got 4 Hard.

When youre buying a home or car dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates. Depending on the credit reporting model all inquiries within a 15- or 45-day period are clumped. Score 732 - 16 inquiries 3 within the last year thought there was only one but there are 3 most of these inquires are rate shopping for a Auto loan but they pulled twice March 13 2009 and April 29th 2009.

It may shave a few points off your credit score but its temporary. Calculate Your Monthly Loan Payment. Theres no set number of inquiries that are too many.

Based on the data this number corresponds to being eight times more likely than average to declare bankruptcy. But having multiple inquiries on your credit report generally makes it more difficult to qualify for a loan. A hard inquiry can typically drop your credit score by 5 8 points but not all inquiries count the same.

Web One big thing that alludes me - Mortgage application shopping around how it affects your FICO and how many Hard Inquiries are counted. Web How to minimize the effect of hard credit inquiries. Understanding how hard inquiries work.

Highest Satisfaction for Mortgage Origination. FICO gives you a 30-day grace period before certain loan. The same is true for.

Web In other words FICO treats similar loan-related inquiries within 14 days of each other as a single inquiry. For example under the FICO Score model inquiries related to auto loan applications within a 45-day period are treated as a single event. Ad Learn More About Mortgage Preapproval.

Web In the contemporary versions of FICO s credit scores for example hard inquiries related to mortgage auto loan and student loan applications are entirely ignored for 30 days from the date of the inquiry. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Those are half 8.

Browse Information at NerdWallet. That said credit bureaus view multiple hard pulls within a period of 14 45 days as one inquiry if youre simply.

Home Loans With Bad Credit What You Need To Know

Mortgage Shopping Without Hurting Your Credit Quicken Loans

Understanding Your Credit Score Mtc Federal Credit Union

Understanding Hard Inquiries On Your Credit Report Equifax

How Many Times Will A Mortgage Lender Pull My Credit

Lake Charles Area Home Finder S Guide November 2022 Volume 37 Issue 5 By Digital Publisher Issuu

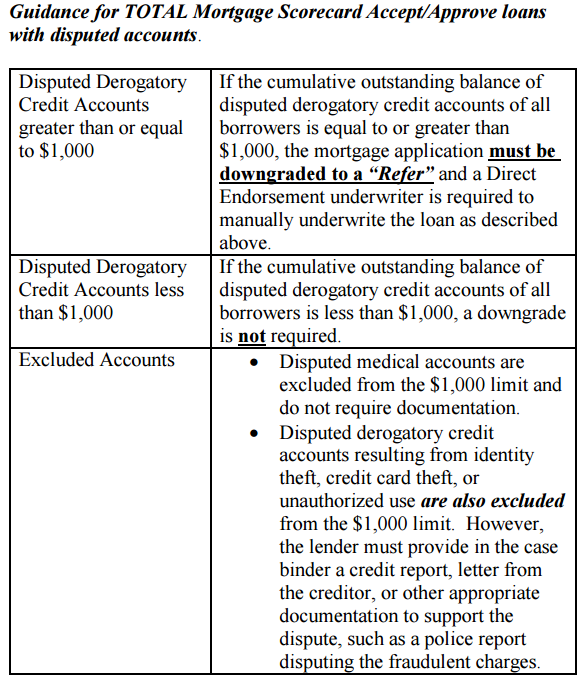

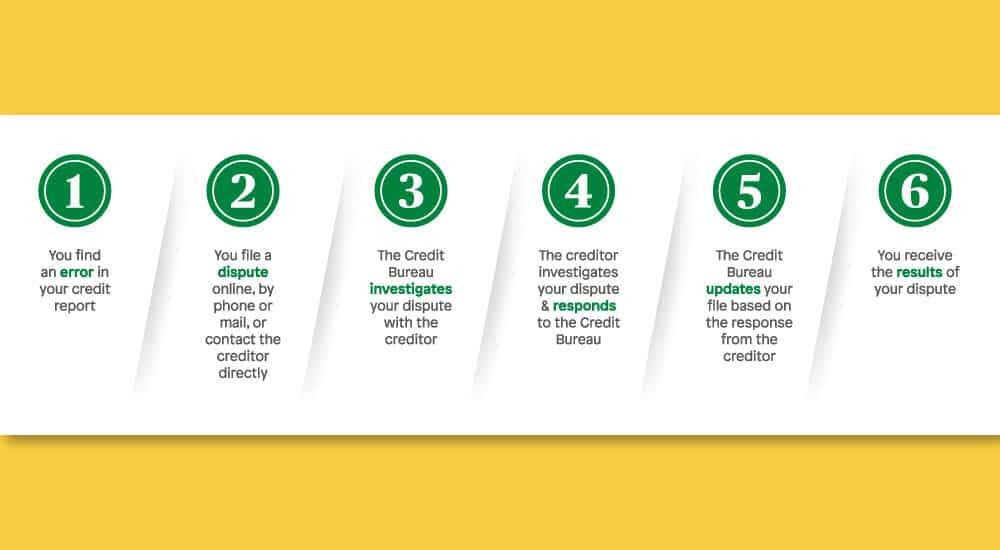

How Fico Credit Report Disputes Can Get Your Home Loan Denied Or Delayed

Letter Of Explanation For A Mortgage Template And How To Write One Credible

Building Rebuilding Credit Life Guidance A Federal Credit Union

Credit Inquiry Knowledge Is Key During A Home Purchase And Mortgage

Understanding Hard Inquiries On Your Credit Report Equifax

How Many Hard Credit Inquiries Is Too Many Money

Tomorrow S Mortgage Executive May 2012 Issue By Progress In Lending Issuu

How Many Times Can You Pull Your Credit For A Mortgage Supermoney

How Many Times Can You Pull Credit For A Mortgage

The Mortgage Network Golden Real Estate S Blog

Understanding Your Credit Score Mtc Federal Credit Union